Debtor's Collection Period

Debtors are organisations or people that owe the business money. This means that debtor's collection period, is the average amount of days it takes, for the business to receive the money it is owed from its customers. The sooner debtors pay the business the better, so a short debtor’s collection period is good. If debtors pay quickly, it helps cashflow and reduces the risk of customers not paying the money they owe.

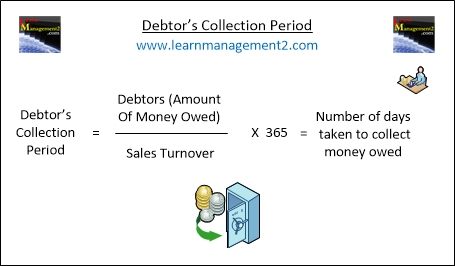

How Do You Calculate The Debtor's Collection Period?

The following calculation is used to calculate The Debtor's Collection Period:

Debtors's Collection Period = Debtors (amount of money owed) x 365 = Number of days taken to collect debt

______________________

Sales Turnover

Example Debtor's Collection Period Calculation

Let’s imagine our fictional business Learnmanagement bookshop LM2 sales turnover is £100000 for the year and they have received most of the money from customers for the books sold. However customers still need to pay LM2 £12000. To calculate the debtor’s collection period for LM2 the following calculation would be used:

Debtors's Collection Period = 1200 x 365 = 43.8

________

100,000

In our example it takes the business 43.8 days to collect the money it is owed by its debtors.