Contingency Planning

Introduction

Things don't always work out as firms would like them to and could cost the firm a lot of money in lost business. This means that firms need a plan for when there is a problem (contingency) to limit the amount of money they lose. This plan is known as a contingency plan and usually covers things that the firm cannot control. Small firms will probably have one contingency plan but large firms will have a number of contingency plans to cover each of their departments and sites.

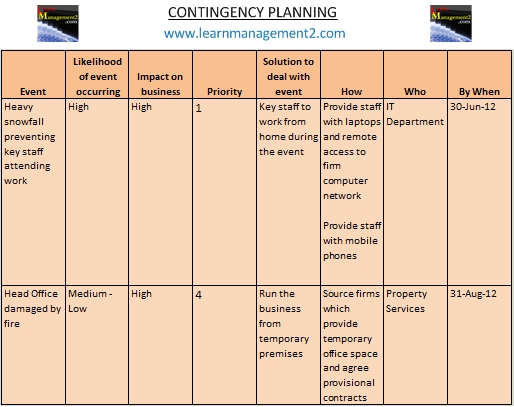

The picture below is an example contingency plan

Examples of Events “Beyond a Firm's Control”

There is an endless list of things that can stop it being “business as usual” for firms. Firms will find it impossible to stop the following things happening:

- A pandemic such as Swine Flu (2009-2010)

- Bad Weather e.g. snow, floods

- Natural disasters e.g. earthquakes, tsunami, volcano ash cloud

- Terrorism and bomb threats

- Suppliers unable/unwilling to deliver goods to the firm

- Distributors/couriers unable to deliver the firm's products to the firm's customers

- Transport issues e.g. closed motorways, cancelled flights, busy roads

- Industrial strikes

- Information Technology (IT) failure/disruption

- Employee absence e.g. due to sickness

- Changes in legislation (the law), health & safety rules, and taxation rules.

- National events e.g. Olympics, football world cup, Super bowl

Drawing up a Contingency Plan

As the events listed above are difficult to prevent it is prudent to draw up a contingency plan to manage their impact. The steps in writing a contingency plan are as follows

- Make a list of events that will stop the firm carrying out its business activities as normal.

- For each event write a solution which describes what the firm will do if the event happens. Also write down any actions that need to be done in preparation for the solution e.g. staff training, drawing up agreements with suppliers, setting up remote working so that people can work from home.

- In your plan group together events that have the same solution. This will stop your plan getting too long and prevent repetition.

- Give each action in your plan a deadline. Prioritise contingency plan actions based on likelihood and impact. Contingency plans for events that are highly likely and will have a big impact on the firm need to be `completed first. Whilst contingency plans for events that are unlikely to happen and will only have a small impact on the firm need to be bottom of the list.

Managing and Communicating Your Contingency Plan

Choose a person to make sure that the actions (solutions) to set up the contingency plan are completed by the agreed deadlines. This person should regularly review action completion and take necessary action if completion is not on track. It is also very important to tell all your employees and anybody that is included in your plan e.g. suppliers, distributors, and retailers about the contingency plan. This will help people understand what they need to do if one of the events (in the plan) happens. Communication should also reduce the number of people “panicking” when things don't go to plan. There are a number of ways to communicate the plan including training sessions and posters.

Conclusion

The good news is that the majority of days are “business as usual” but on the rare occasion that a day is not as normal, a contingency plan will minimise business disruption. A good contingency plan will limit losses and enhance your firm's reputation. Contingency plans may take time to set up but you will get more than the time you invested (in the plan) back, the first time you use the contingency plan. Finally to make sure your plan continues to be an effective solution, review it periodically to make sure it still meets business needs.