Business Costs, Revenue And Breakeven

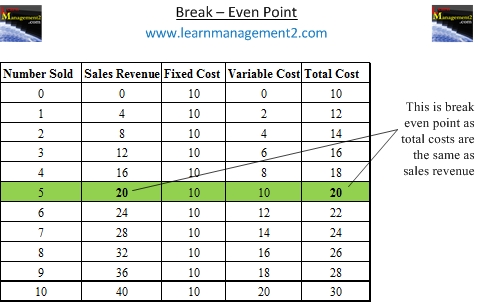

All businesses need to keep records of how much money they are spending and how much money they are receiving in. If they do not do this they could end up losing a lot of money and even getting into trouble with the tax authorities. This article is about three important money terms revenue, costs and break even.

Revenue

Revenue is the money that comes into the business e.g. from sales, interest on savings, product licensing and rent agreements. Sales revenue is calculated by multiplying the number of sales, with the price charged for the items sold. For example if I sell ten sweets for £1.20 my revenue is £12.00. Do not confuse sales revenue with profit as revenue looks at how much money has come into the business, without taking costs into account. Whereas profit looks at how much money has come into the business and the costs involved in generating that money.

Costs

Costs are categorised in two ways; fixed costs and variable costs or start up and running costs. The items that make up costs depend on the type of business and its setup.

- Fixed Costs Or Overheads - These are costs that will not change if the business increases or decreases business activity. This means fixed costs have to be paid even when the business is not carrying out any business activity. Examples of fixed costs or overheads are rent for the business premises, interest on loans or business rates charged by local government/councils and salaries. It is worth remembering fixed costs may not be fixed for ever for example landlords may change the amount of rent or loans may be paid or increased. Fixed costs are said to be connected with time (time related) as they have to be paid regularly i.e. weekly monthly quarterly annually.

- Variable Costs - These are costs that will change if business activity changes. This is because when business activity increases more resources such as materials and utilities (gas, electricity, fuel etc) are used. Conversely when business activity decreases the business needs less resources.