Business Mergers And Acquisitions

Introduction

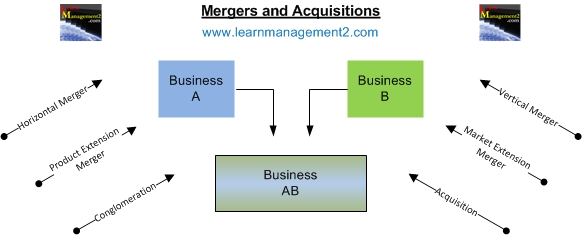

In addition to expanding a business through increased trading, mergers and acquisitions can be used to increase the size of an organisation and its profits.

Acquisition

An acquisition is the purchase or takeover of another business, so that the organisation becomes the legal owner and controller of the business they have acquired. This can be expensive as the acquiring company will be paying for the net assets, goodwill and brand name of the company they are buying. With an acquisition no consent is given by the company being taken over

Merger

A merger is where two or more businesses join forces to become one organisation. After the merger, each of the businesses and their shares will no longer exist. Instead a new legal entity has been formed. Decisions will need to be made regarding the future of the newly merged organizations including who will lead and manage the business and how cost efficiency will be achieved. With a merger consent is given, it is sometimes referred to a marriage between two companies.

Merger Types

Mergers can be defined according to the business similarities and differences, between the two companies that are merging. Often the type of merger will give us a clue when it comes to deducing, the reasons behind the merger. Below are some examples of the different types of merger;

Horizontal merger:

This occurs when two companies that are in direct competition with each other in the same product lines and markets decide to merge.

Vertical merger:

This occurs when a supplier company, mergers with a company that they supply goods or services to i.e. supply and customer decide to merge. An example of this is a pizza restaurant chain merging with the company that supplies them with pizza bases.