Liquidity Ratios

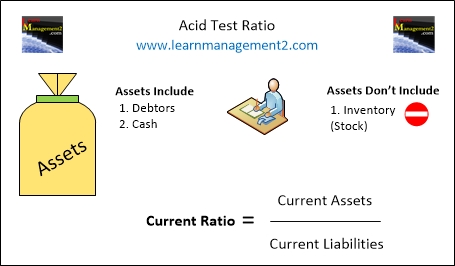

Acid Test Ratio

Firms often need to borrow money to invest in the business and help it grow. Debts are not a problem as long as they are managed properly. The Acid Test ratio can be used to find out if a firm is borrowing money sensibly. The Acid Test ratio looks at whether a firm has enough current assets to pay back its short term debt (current liabilities). The Acid Test ratio is different to the Current Ratio because stock is not included in the (value of the) current assets used in the calculation.

Why is Stock (inventory) Not Included In the Calculation?

Stock (inventory) can not always be converted into cash quickly. Inventory can “go out of date”, get damaged or lose value, so the acid test ratio shows you how many times the business can pay off its current liabilities, if stock is not included as a current asset.

How Do I Calculate the Acid Test Ratio For a Firm

Acid Test Ratio Current Assets - Stock

= __________________

Current Liabilities

Example Calculation

For example if my current assets are £9000 which includes £3000 of stock and my current liabilities are £2000, I would work out my current ratio as follows

Current Assets - Stock 9000 – 3000 6000

_________________ = _________ = _____ = 3

Current Liabilities 2000 2000