Liquidity Ratios

Current Ratio (Working Capital Ratio)

Financial Ratios assess how well a business is doing, they usually involve comparing performance against the amount of money invested in the business. Liquidity ratios examine whether a business has enough money to pay the money it owes.

In this article we look at how to calculate the current ratio, which is one of two liquidity ratios; the other liquidity ratio is called the Acid Test Ratio.

How Do You Calculate The Current Ratio?

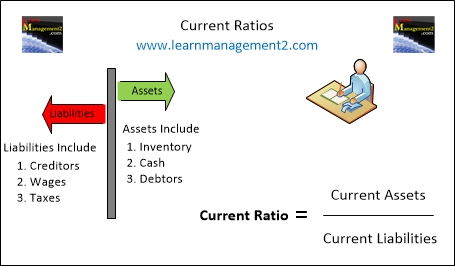

The current ratio is sometimes called the working capital ratio. It is calculated by dividing current assets by current liabilities.

Current Ratio Current Assets

= _________

Current Liabilities

Example

For example if my current assets are £4000 and my current liabilities are £2000 I would work out my current ratio as follows

Current Assets 4000

_________ = _________ = 2

Current Liabilities 2000

How to write Liquidity Ratios

As Liquidity ratios are expressed against 1, the ratio for the example above is 2:1. This means that in the example there is enough money to pay the liabilities twice.