Financial Statements

Balance Sheets (Statement Of Financial Position)

A balance sheet is a record of

- What the business owns (assets) and

- What the business owes to others (liabilities)

Anybody looking to invest money in the business, lend the business money or enter into a contract with the business will find it useful as it shows how financially secure the business is. However it is important to note that the balance sheet is a “snapshot”, it shows assets and liabilities that the business had at the time the balance sheet was prepared. To obtain a better view it may be useful to examine balance sheets dating back a number of years.

Assets

A balance sheet shows fixed assets, current assets and other assets, lets look at each one in turn.

Fixed Assets

Fixed assets are assets that the business will own for at least a year. For example

- Machinery

- plant

- Land

- Buildings and

- Vehicle

Current Assets

Current Assets are assets that can be turned into money (cash). For example

- Stock (through selling it)

- Debtors (through them paying back the money they owe the business)

- Cash belonging to the business

Other Assets

The Other Assets category captures all assets that are not fixed or current assets.

Liabilities

A balance sheet shows liabilities. There are three types of liability:

- Shareholder funds (this is a liability because the business is a separate legal entity from the owners, so any money they invest is simply a type of loan to the businesses)

- Long term liabilities (money owed by the business which the business has more than a year to pay back)

- Current liabilities (money owed by the business which the business has less than a year to pay back). For example bank overdraft or money owed to suppliers.

Compiling A Balance Sheet

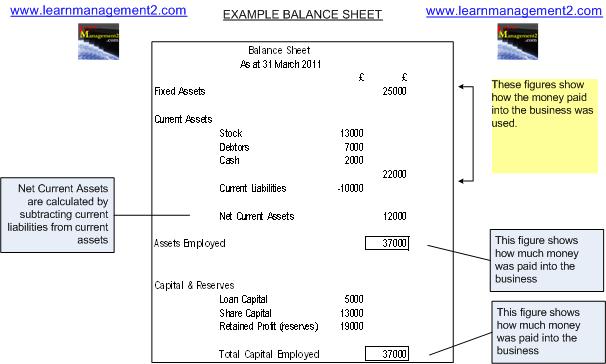

Under company law accounts prepared by companies must be prepared in a vertical column format. The left hand column shows individual figures. The right hand column shows the totals of the individual figures for example total fixed assets, net current assets. The top section of the balance sheet will show the value of assets and liabilities, whilst the bottom section will detail the money invested in the business (capital invested) and retained profit.

The total for the top section includes a net current assets total so that businesses can see how much liquidity or working capital is available to them. Net current assets are calculated by subtracting current liabilities from current assets.

Net Current Assets = Current Assets Minus Current Liabilities

This is because current assets can be quickly turned into cash and used as working capital but some of this money might be needed to pay back current liabilities.

Why Is A Balance Sheet Called A "Balance Sheet"?

This financial statement is called a balance sheet because the totals figure for the top section (assets and liabilities) must match the bottom totals figure (capital investment plus retained profit). The balance sheet shows how the businesses money (retained profit, loan capital and capital investments) have been divided between the business' assets and liabilities.

What If The Totals Match?

If the top and bottom section totals on a balance sheet do not match it means that some of the business' money is unaccounted for or there are errors in the calculations used to arrive at the totals (assets and liabilities total and capital investment plus retained profit total).

Conclusion

The number of assets and liabilities owned by a business can change so balance sheets show the value of a business on a particular date. This needs to be considered when assessing the financial strength of a company, ensure that you look at other financial statement such as cashflow and profit and loss account. It is also worth reviewing previous balance sheets and investigating the firm's future plans. We hope you enjoyed this article, we also have a number of related articles for you:

Profit and Loss Accounts |

Cashflow Accounts |

Profitability Ratios |

Working Capital And Liquidity